Investor Relations

-

Shareholder Services

Shareholder Services -

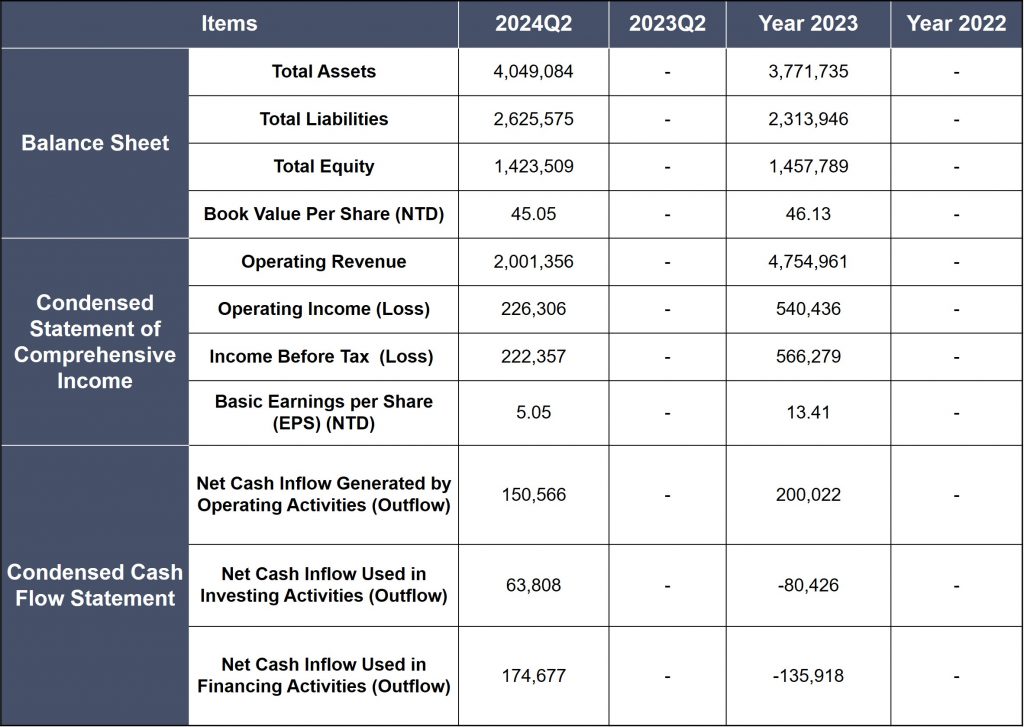

Financials

Financials -

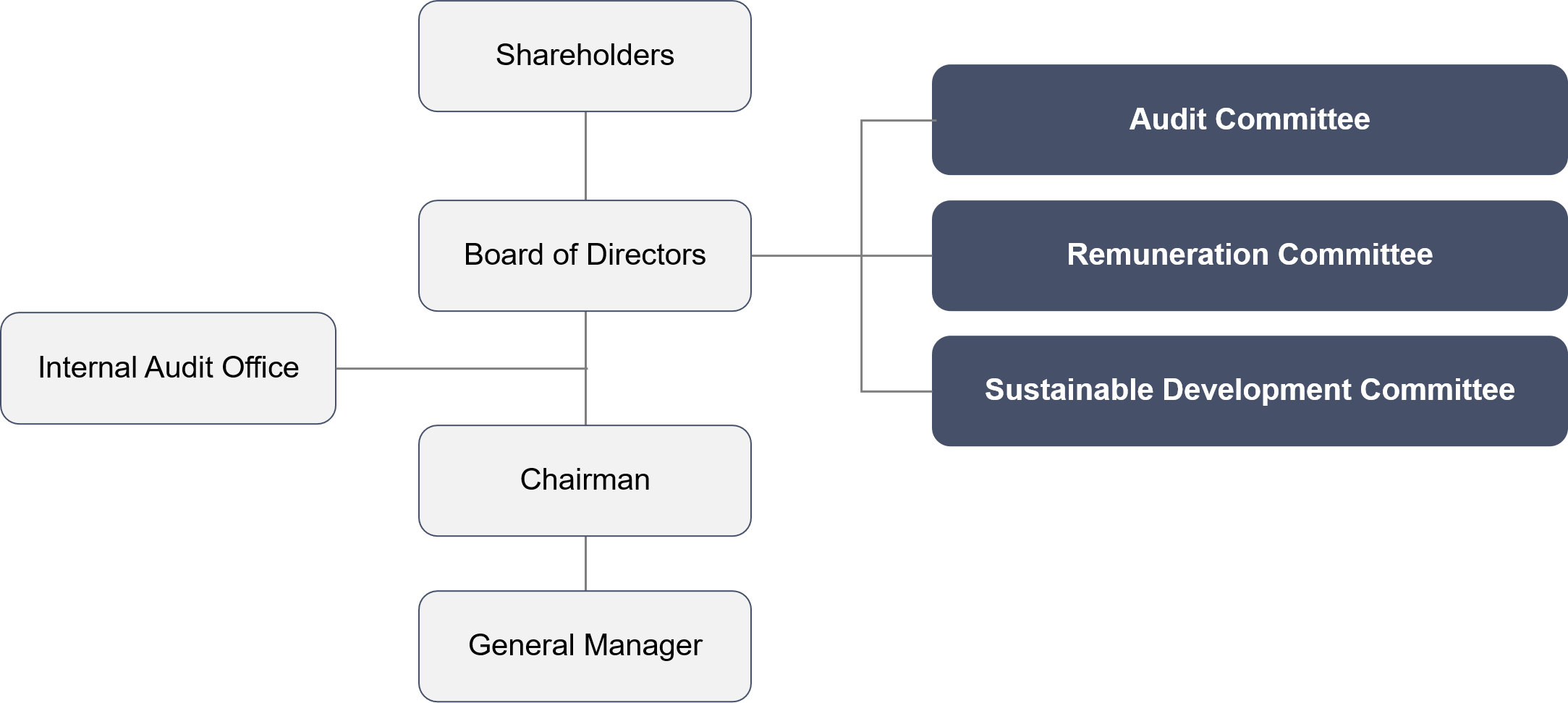

Corporate Governance

Corporate Governance -

Organizational Structure

Organizational Structure -

Stakeholder Section

Stakeholder Section -

Whistleblower Policy

Whistleblower Policy

- Meeting Information

- Material Information

- Investor Conference

- Contact Information

Meeting Information

List of Major Shareholders

2024 Shareholders' Meeting

Material Information

Steps to Search on the Market Observation Post System (MOPS)

*Only available in Traditional Chinese

http://mops.twse.com.tw/mops/web/index

- Enter the company code: 7792

- Select: “重大資訊 / 公告“ > “重大訊息查詢” > “歷史重大訊息”

- Enter the year (ROC Calendar), month (optional), and date (optional)

Investor Conference

AMPOWER was invited to participate in the pre-OTC briefing organized by Yuanta Securities.

Date

17 December 2024

Time

14:30

Location

Far Eastern Shangri-La Hotel, B1 Metropolitan Hall (201, Dunhua South Road, Section 2, Taipei)

Key Highlights

Our company was invited to participate in the pre-OTC briefing organized by Yuanta Securities to present an overview of our business operations and future prospects.

Contact Information

Investor Relations

(02)2910-8118

IR@ampower.com.tw

Media Contacts

(02)2910-8118

marketing@ampower.com.tw

Corporate Sustainability

(02)2910-8118

ehs@ampower.com.tw

Stock or Corporate Bond Certification Agency

Hua Nan Commercial Bank, Trust Dept.

15F, No. 123, Songren Rd., Xinyi Dist., Taipei City

(02)2371-3111

https://www.hncb.com.tw

Stock Transfer Agent

Yuanta Securities Co., Ltd., Shareholder Services Dept.

B1, No. 210, Sec. 3, Chengde Rd., Datong Dist., Taipei City

(02)2586-5859

www.yuanta.com.tw/eyuanta/agent

Recent Fiscal Year Certified Public Accountant

KPMG

68F, No. 7, Sec. 5, Xinyi Rd., Taipei City

(02)8101-6666

http://kpmg.com/tw

- Operating Revenue

- Financial Reports Under IFRSs

- Financial Report

- Accounting Standards

Operating Revenue

(Unit: NTD'000)

YTD Revenue

629,746

YTD Revenue

537,618

YTD Growth Rate

17.14%

2025.02 Revenue

361,787

2024.02 Revenue

256,937

Growth Rate

40.81%

2025.01 Revenue

267,959

2024.01 Revenue

280,681

Growth Rate

-4.53%

2024.12 Revenue

918,399

2023.12 Revenue

522,665

Growth Rate

75.71%

2024.11 Revenue

444,310

2023.11 Revenue

369,087

Growth Rate

20.38%

Financial Report

The company has internal regulations prohibiting directors, employees, and other insiders from trading securities based on non-public market information. These regulations include, but are not limited to, a blackout period during which directors are restricted from trading company stock within 30 days before the announcement of the annual financial report and 15 days before the announcement of each quarterly financial report.

- Company Profile

- Board of Directors

- Functional Committees

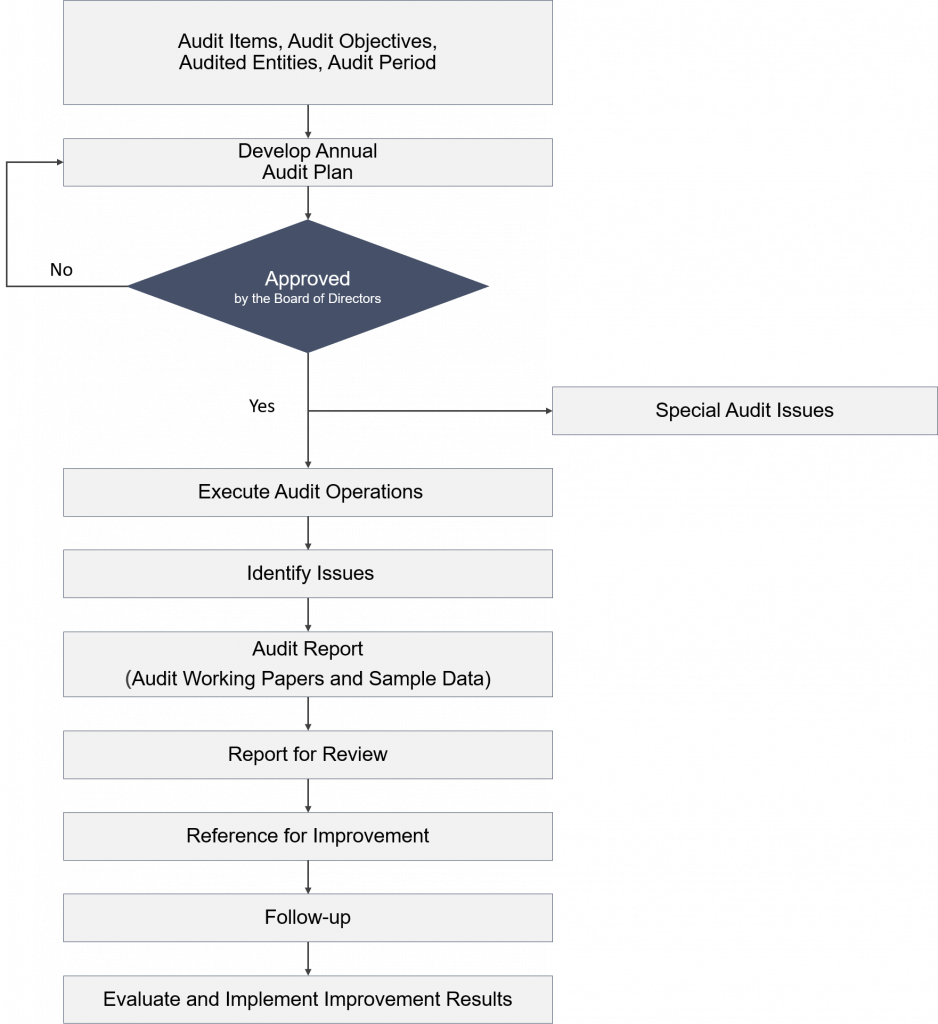

- Internal Audit System

- Value Enhancement

- Risk Management

- Major Internal Policies

- Information Security

Company Profile

Stock Code

7792

Industry Category

Other Electronics Industry

Company Name

AM-POWER MACHINE INTERNATIONAL ENTERPRISE CO.

Main Phone Line

(02)29108118

Address

5F., No. 207-5, Sec. 3, Beixin Rd., Xindian Dist., New Taipei City Taiwan

Fax Number

(02)29106689

Chairman

CHEN, CHIH-FU

General Manager

CHEN, CHIH-FU

Spokesperson Phone Number

CHEN, CHIH-FU

Deputy Spokesperson

CHEN, KUANG-YUN

Spokesperson Phone Number

(02)2910-8118

Deputy Spokesperson Phone Number

(02)2910-8118

Spokesperson Email

IR@ampower.com.tw

Deputy Spokesperson Email

IR@ampower.com.tw

Principal Business Activities

Renewable Energy Self-Generation Equipment Industry Energy Technology Services Industry Power Generation, Transmission, and Distribution Machinery Manufacturing

Date of Incorporation

1994/02/04

Business Registration Number

84751639

Paid-in Capital

NTD 426,720,000

Emerging Stock Market Listing Date

2024/12/18

Stock Transfer Agency

Yuanta Securities Co., Ltd. Stock Transfer Agency Dept.

Phone

(02)2586-5859

Transfer Agent Address

B1, No. 67, Sec. 2, Dunhua South Road, Da’an District, Taipei City 106, Taiwan

Auditing Firm

KPMG

English Abbreviation

AM-POWER

English Full Name

AM-POWER MACHINE INTERNATIONAL ENTERPRISE CO.

Board of Directors

- Board Members

- Functional Committee

Joined the Board in 1994

- Master’s Degree in Civil Engineering, University of Southern California, USA

- Project Manager, KBR, Texas, USA

- General Manager, AM-POWER MACHINE INTERNATIONAL ENTERPRISE CO.

Joined the Board in 2021

- Graduate, Department of Mechanical Engineering, Cheng Shiu Institute of Technology, Taiwan

- MBA, Nanyang Technological University, Singapore

- General Manager, Hong Guang Engineering Consultants Ltd.

- Director & General Manager, AM-POWER MACHINE INTERNATIONAL ENTERPRISE CO.

- Legal Representative & General Manager, Ningbo AMPOWER Automatic Systems Co., Ltd.

- Legal Representative & General Manager, Shanghai AMPOWER Energy Technology Co., Ltd.

Joined the Board in 2021

- Bachelor’s Degree in Chinese Literature, National Taiwan University

- Department Head, Sanitary Ware Division, Kao Lin Industrial Co., Ltd.

- Executive Vice President, AM-POWER MACHINE INTERNATIONAL ENTERPRISE CO.

- Director, AM-POWER MACHINE INTERNATIONAL ENTERPRISE CO.

Joined the Board in 2024

- Associate General Manager, Hwatai Bank Ltd.

Joined the Board in 2024

- MBA, National Chengchi University, Taiwan

- Chairman & General Manager, Antec Electric Co., Ltd. (Hon Hai Group)

- Chairman, Synergy Investment Co., Ltd

Joined the Board in 2024

- Bachelor’s Degree in Law, National Taiwan University

- Partner, Lee and Li Attorneys-at-Law

Joined the Board in 2024

- Master’s Degree in Accounting, National Chung Cheng University, Taiwan

- Bachelor’s Degree in Accounting, National Chengchi University, Taiwan

- Chief Financial Officer, Formosa Pharmaceuticals, Inc.

- Senior Manager, General Management Office, Lumosa Therapeutics Co., Ltd.

- Deputy Manager, Accounting Department, TTY Biopharm Co., Ltd.

- Deputy Manager, Finance Department, EDOM Technology Co., Ltd.

- Manager, CROWN & Co., CPAs

- Supervisor, Yu Chuan Technology Co., Ltd.

- Senior Auditor, PwC Taiwan

The Company’s Board composition follows the Corporate Governance Best Practice Principles and Director Election Procedures, ensuring diversity in multiple aspects. The Board consists of seven directors, including three independent directors and one female director. To maintain balanced governance, directors serving as executives shall not exceed one-third of total board seats. A diversity policy is set based on the Company’s operations and development needs.

Board members must have the knowledge, skills, and expertise required to perform their duties. The Board as a whole should demonstrate business judgment, financial and accounting expertise, management skills, crisis handling, industry knowledge, international market insight, leadership, and decision-making abilities.

The Company’s current board diversity policy and its implementation are outlined as follows:

The Company’s Board consists of seven directors, including three independent directors, accounting for 42.86% of the Board. All independent directors comply with the Regulations Governing Appointment of Independent Directors. Additionally, the four non-independent directors have no familial relationships within the second degree of kinship, and there are no conflicts of interest as defined in Article 26-3, Paragraphs 3 and 4 of the Securities and Exchange Act.

Board members are primarily selected based on their experience relevant to the Company’s industry and operations. Collectively, the Board possesses expertise in business management, finance and accounting, information technology, industry experience, and specialized knowledge, spanning multiple sectors with complementary skills. In terms of age diversity, most board members fall within the 61–70 age range, ensuring a well-balanced composition.

Functional Committees

To enhance oversight and strengthen management functions, the Board of Directors established three functional committees on November 21, 2024: the Audit Committee, the Remuneration Committee, and the Sustainability Committee.

Name and Profiles:

Independent Directors:

CHANG, CHIEN-JEN (Chairman, Synergy Investment Co., Ltd)

LI, WEN-CHIEH (Partner, Lee and Li Attorneys-at-Law)

PAN, LI-FANG (Chief Financial Officer, Formosa Pharmaceuticals, Inc.)

To strengthen oversight and enhance governance, the Audit Committee was established by the Board on November 21, 2024. The committee consists ntirelye of independent directors, with at least three members, one serving as the convener, and at least one possessing expertise in accounting or finance.

Responsibilities of the Audit Committee:

- Establish or amend the internal control system in accordance with Article 14-1 of the Securities and Exchange Act.

- Assess the effectiveness of the internal control system.

- Establish or amend procedures for major financial transactions, including asset acquisitions/disposals, derivatives trading, lending of funds, and guarantees, as per Article 36-1 of the Securities and Exchange Act.

- Review transactions involving director conflicts of interest.

- Oversee major asset or derivatives transactions.

- Evaluate significant loans, endorsements, or guarantees.

- Approve the issuance or private placement of equity-related securities.

- Appoint, dismiss, or determine the remuneration of the certified public accountant (CPA).

- Approve the appointment or dismissal of senior executives in finance, accounting, or internal audit.

- Review annual financial statements and Q2 financial reports, signed by the Chairman, management, and accounting officers, and certified by an independent CPA.

- Address other material matters as required by the company or regulatory authorities.

Name and Profiles:

Independent Directors:

CHANG, CHIEN-JEN (Chairman, Synergy Investment Co., Ltd)

LI, WEN-CHIEH (Partner, Lee and Li Attorneys-at-Law)

PAN, LI-FANG (Chief Financial Officer, Formosa Pharmaceuticals, Inc.)

To strengthen oversight and enhance management functions, the Board of Directors established the Compensation Committee on November 21, 2024. The committee members are appointed by board resolution and consist of at least three members, including at least one independent director or independent professionals. The members elect a chairperson who also serves as the meeting convener.

Responsibilities of the Remuneration Committee:

- Regularly review and propose amendments to this charter.

- Establish and periodically review the performance evaluation criteria and objectives for directors and executives, as well as the compensation policies, systems, standards, and structures.

- Periodically evaluate the performance of directors and executives and determine their compensation based on performance assessments.

Name and Profiles:

Directors:

CHEN, CHIH-FU (Chairman, AM-POWER MACHINE INTERNATIONAL ENTERPRISE CO.)

CHEN, KUANG-YUN (Director, AM-POWER MACHINE INTERNATIONAL ENTERPRISE CO.)

Independent Directors:

LI, WEN-CHIEH (Partner, Lee and Li Attorneys-at-Law)

To fulfill corporate social responsibility, address stakeholder concerns on Environmental, Social, and Governance (ESG) risks and responses, and align with global trends, the Board of Directors established the Sustainability Committee on November 21, 2024. The committee serves as the decision-making and supervisory body for the company’s sustainability initiatives, covering three key areas: Environment (E), Social (S), and Governance (G). It is also responsible for assisting the Board in advancing sustainable development and long-term business sustainability.

Responsibilities of the Sustainable Development Committee:

- Develop, implement, and enhance the company’s sustainability policies, annual plans, and strategies.

- Review, monitor, and revise the execution and effectiveness of sustainability initiatives.

- Oversee sustainability disclosures and review the Sustainability Report.

- Supervise the implementation of the company’s Sustainability Guidelines and other sustainability-related initiatives approved by the Board.

Internal Audit System

The purpose of Internal Audit is to assist the Board of Directors and management in reviewing and assessing deficiencies in the internal control system, evaluating operational effectiveness and efficiency, and providing timely recommendations for improvements. This ensures the continued effectiveness of the internal control system and serves as a basis for its review and enhancement.

- Internal audit is an integral part of the internal control system, focused on assessing its effectiveness, evaluating operational performance, and providing timely improvement recommendations to ensure continued and effective implementation of the system.

- The internal audit aims to support the Board of Directors and management by identifying deficiencies in the internal control system and assessing operational efficiency. It also provides recommendations for improvements and serves as a basis for reviewing and refining the system.

- To fulfill its role, internal audit personnel are granted complete autonomy to audit all operational conditions and records within the company.

- Review the internal control system to evaluate the effectiveness of existing policies and procedures, as well as their impact on business operations.

- Define the audit scope, timeline, procedures, and methodologies.

- The Audit Unit and its deputies shall conduct audits in accordance with the relevant provisions of these guidelines.

- Audit subjects include all company departments, branches, and subsidiaries.

- Internal audits are categorized into regular and special (project-based) audits. Regular audits follow the Annual Audit Plan, while special audits are conducted as instructed by the Board of Directors (or the Audit Committee) or senior management.

Corporate Value Enhancement Plan

Since 1994, AMPOWER has specialized in comprehensive energy solutions, including emergency backup power, energy storage systems, and combined heat and power (CHP) systems. With over 30 years of experience in technology and engineering integration, we’ve become a trusted partner for major domestic and international listed companies.

Amid global shifts toward energy transition, low-carbon economies, and digitalization, this proposal outlines our strategy to enhance industry value, strengthen market position, and drive sustainable growth. It covers cost analysis, profitability, market evaluation, risk assessment, and plans for future development.

Our aim is to provide investors, partners, and stakeholders with a clear roadmap to advance in Taiwan and the global energy market—driving a smarter, greener, and more sustainable future.

Risk Management

Risk Management Framework

The Board of Directors is fully responsible for the establishment and oversight of the merged company’s risk management framework.

The risk management policy of the merged company is designed to identify and analyze the risks the company faces, set appropriate risk limits and controls, and monitor the compliance with risk limits. The risk management policies and systems are reviewed periodically to reflect changes in market conditions and the operations of the merged company. The merged company develops a disciplined and constructive control environment through training, management guidelines, and operational procedures, ensuring that all employees understand their roles and responsibilities.

Credit Risk – Accounts Receivable and Other Receivables

Credit risk refers to the risk of financial loss to the merged company due to a customer or counterparty in a financial instrument failing to fulfill their contractual obligations, primarily arising from accounts receivable from customers.

The merged company has established a credit policy, under which each new customer undergoes management and credit risk analysis before setting terms and conditions for entering into contracts or delivering goods. Internal risk controls are implemented by evaluating the customer’s financial condition, past experience, and other factors to assess their credit quality.

Liquidity Risk

Liquidity risk refers to the risk that the merged company may not be able to meet its financial obligations as they come due, such as failing to settle financial debts. The company manages liquidity risk by ensuring, as much as possible, that it has sufficient liquidity to meet its debt obligations in both normal and stressed conditions, thus avoiding unacceptable losses or damage to the company’s reputation.

Market Risk

Market risk refers to the risk of changes in market prices, such as exchange rates, interest rates, or equity prices, affecting the merged company’s income or the value of its financial instruments. The objective of market risk management is to control the extent of exposure to market risks within acceptable limits and to optimize investment returns.

Interest Rate Risk

The merged company’s short-term and long-term borrowings are subject to floating interest rates. As a result, changes in market interest rates will cause fluctuations in the effective interest rate of short-term borrowings, leading to variations in future cash flows. However, given the stable financial environment and limited changes in market interest rates, the company does not anticipate significant risk from interest rate fluctuations.

Foreign Exchange Risk

The merged company is exposed to foreign exchange risk arising from sales, purchases, and borrowing transactions that are denominated in currencies other than its functional currency. The primary currency for these transactions is USD. To manage foreign exchange risk, the merged company buys or sells foreign currencies at prevailing exchange rates, maintaining its net foreign currency position within a set limit.

Other Market Price Risks

The merged company holds financial assets measured at fair value through profit or loss, primarily structured financial products. Therefore, market price changes will affect the investment value. The company’s financial assets subject to interest rate-related fair value risk include bank deposits, while financial liabilities include short-term and long-term borrowings. The impact of interest rate changes on the fair value of these financial assets and liabilities is not considered significant.

Major Internal Policies

- Rules of Procedure for Shareholders' Meetings

- Sustainability Information Management Policy

- Guidelines for Financial and Business Transactions Between Related Parties

- Procedures for Handling Material Inside Information and Preventing Insider Trading

- Sustainable Development Committee Charter

- AMPOWER Sustainability Best Practices Code

- Procedures for Suspension and Resumption of OTC Stock Trading

- Rules Defining the Duties of Independent Directors

- Audit Committee Charter

- Audit Committee Meeting Procedures

- Corporate Governance Best Practice Principles

- Ethical Corporate Management Best Practice Principles

- Procedures and Guidelines for Ethical Business Operations

- Code of Ethical Conduct

- Remuneration Committee Charter

- Remuneration Committee Operational Procedures

- Guidelines for Director and Executive Compensation

- Procedures for Lending of Company Funds

- Shareholder Services Management Policy

- Internal Audit Implementation Rules

- Personal Data Protection Policy

- Procedures for Acquisition and Disposal of Assets

- Related Party Transaction Policy

- Rules of Procedure for Board of Directors Meetings

- Information Security Management Policy

- Regulations for Board Performance Evaluation

- Procedures for Information Security Incident Response

- Procedures for Applying for Suspension and Resumption of Trading

- Standard Operating Procedures for Handling Board of Directors' Requests

Information Security

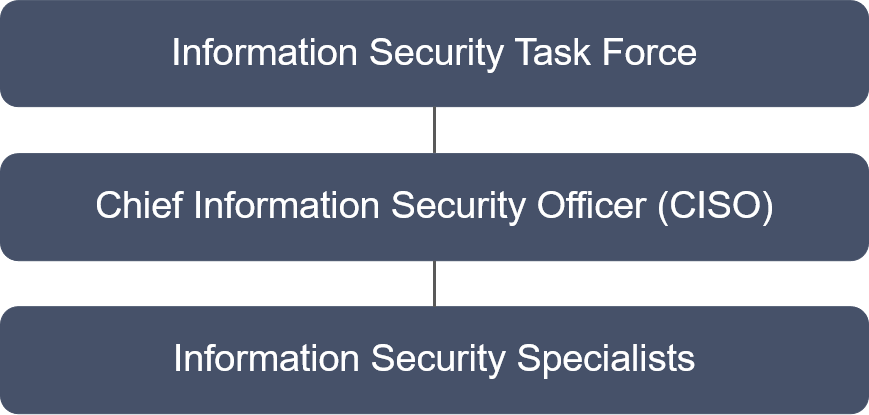

Information Security Organization

Our company follows the "Regulations Governing the Establishment of Internal Control Systems by Public Companies" and the "Information Security Management Guidelines for Listed Companies" to actively implement our information security policies and protection measures. We have established an Information Security Task Force, led by the Executive Vice President as the head and convener, along with certified professionals. This team is responsible for planning, executing, auditing, and improving information security management operations. Regular meetings are held to review security policies and set future development directions.

Information Security Policy

1. Comply with relevant information security laws and implement protective measures for company IT assets to ensure data confidentiality, integrity, and availability, supporting continuous business operations against internal and external threats.

2. Deploy information security protection systems, enhance IT infrastructure defense, and participate in threat intelligence platforms to mitigate cybersecurity risks.

3. Conduct regular employee training and awareness programs to strengthen cybersecurity risk awareness.

4. Periodically assess potential threats, establish business continuity plans, conduct operational drills, and implement multi-layered backup mechanisms to ensure uninterrupted business operations.

Information Security Management Plan and Implementation

1. Our company has established management policies, including the "Information Security Management Policy," "Computer System and Equipment Usage Policy," and "Trade Secret Protection Policy," to enhance risk management.

2. An annual budget is allocated for upgrading IT infrastructure, acquiring cybersecurity detection tools such as endpoint detection and response (EDR) and vulnerability scanning, and enhancing corporate cybersecurity defense.

3. Continuous improvements in information security system management include regular security assessments, drills, and emergency response training to prevent security incidents and establish incident reporting and response mechanisms.

4. Regular cybersecurity training and social engineering drills are conducted to enhance employee awareness. Additionally, updated security advisories and best practices are shared periodically. An annual budget is allocated to replace outdated IT equipment and software to reduce security vulnerabilities.

5. Our company employs firewalls, antivirus software, email security filters, and centralized endpoint management to enforce security policies and access controls.

6. A multi-tiered backup and off-site backup mechanism is implemented, along with regular disaster recovery drills to ensure data availability and integrity.

Information Security Incident Reporting Procedures

In the event of an information security incident, the affected department must immediately notify the IT department in accordance with incident response procedures. Security personnel will assess the nature of the incident, identify root causes, take immediate action, and document the resolution process.

2024 Information Security Management Performance

No major cybersecurity incidents occurred in 2024, meeting our information security management objectives.

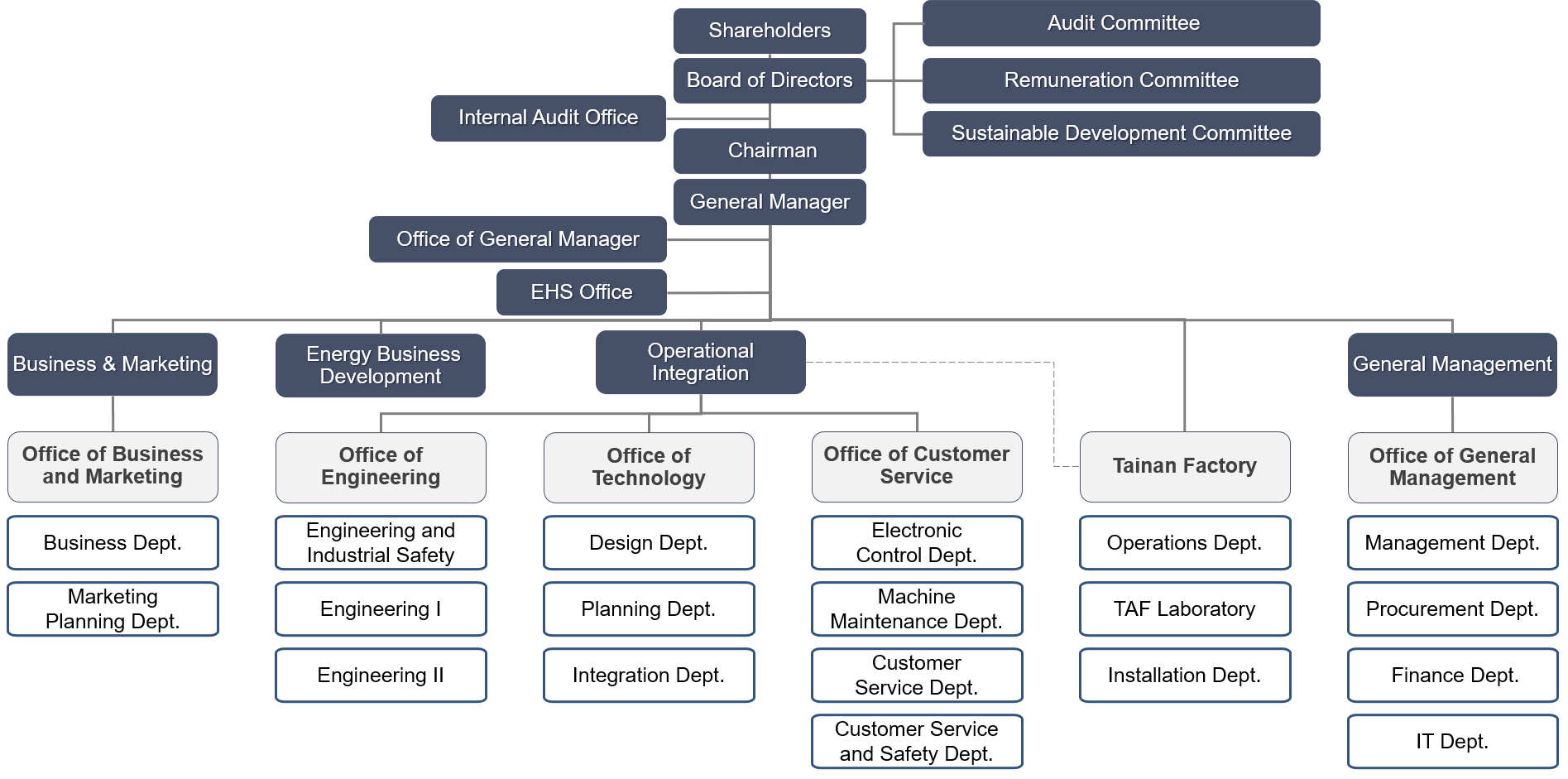

Operations of Key Departments

Assist the General Manager in implementing corporate policies and reviewing the achievement of business objectives and OKRs.

Responsible for business and marketing strategy planning and development.

- Business Department:

Responsible for business expansion, customer relationship management, and maintenance of diesel generators, DUPS, gas engines, biogas engines, and UPSI-related businesses.

- Marketing & Planning Department:

Responsible for brand marketing strategy execution, business administration, and project support.

Develop and promote greenhouse gas mitigation and adaptation strategies in response to global climate change, as well as planning and implementing strategies for energy acquisition, storage, conversion, and supply-demand reliability.

Responsible for engineering projects, after-sales services, and technical development strategies.

- Responsible for the execution and management of engineering projects.

- Responsible for on-site occupational safety and health management of engineering projects.

- Responsible for execution and management of Hookup projects, busbar systems, and UPSI-related engineering projects.

Responsible for technical strategy, engineering project management planning, standardization of new and existing product technologies, outsourced design development, and technology transfer.

- Planning Department:

Responsible for contract cost estimation, KOM #1 project handover, project agreement documentation, engineering change management, SAP case control, project material tracking, price setting for project equipment, and baseline cost estimation maintenance.

- Design Department:

Responsible for architectural requirement drawings, MEP equipment layout planning, installation design management, and outsourced design.

- Engineering Integration Department:

Responsible for product specification planning, design of electrical control and power distribution panels, bid confirmation, and procurement management.

Responsible for the development of maintenance and repair services and technical planning.

- Electrical Control Department: Responsible for maintenance and repair business development and technical planning.

- Mechanical Maintenance Department: Responsible for planning and managing mechanical maintenance and repair operations.

- Customer Service Department: Responsible for planning and managing maintenance and repair services.

- Customer Service & Safety Department: Responsible for on-site occupational safety and health management for maintenance and repair operations.

Responsible for strategic planning and development of various engineering integration projects.

- Operations Department:

Responsible for inventory management, administrative operations, plant facility maintenance, periodic audits, and operation of fuel, water, gas, and electricity infrastructure.

- TAF Laboratory:

Responsible for the establishment, maintenance, and operation of the generator set TAF laboratory.

- Installation Department:

Responsible for product processing, piping, wiring, equipment transportation, and execution of high-risk operations (such as working at heights, hoisting, welding, confined spaces, and organic solvents), as well as occupational safety and health management.

Responsible for strategic planning and development of corporate operations management.

Responsible for corporate operations management planning and oversight of procurement, finance, IT, HR, and general affairs.

- Finance Department: Responsible for financial reporting, fund management, budget planning, cost analysis, tax planning, and investment evaluation.

- Management Department: Responsible for human resources, general administration, policy development, and process optimization.

- Procurement Department: Responsible for domestic and international procurement and logistics operations.

- IT Department: Responsible for IT policy development, information systems, and cybersecurity planning and implementation.

Responsible for establishing and maintaining environmental, safety, and health (ESH) systems, conducting ESH audits, and continuously improving ESH management mechanisms.

Responsible for evaluating corporate operational management systems, providing improvement recommendations, and ensuring the effective implementation of internal control mechanisms.

- Stakeholder Services

- Dividend Policy

Employees

We are committed to fostering a supportive workplace by providing comprehensive benefits and career development opportunities. Our employee benefits include domestic and international travel, health check-ups, holiday and birthday bonuses, financial assistance for life events, corporate activities, wellness seminars, professional training subsidies, and group insurance—ensuring a positive and fulfilling work environment.

To support career growth, we offer structured training programs tailored to employees’ professional development needs, helping them enhance their skills and leadership abilities while delivering the best service to our clients.

For retirement planning, we follow the Labor Pension Act with a defined contribution system, making monthly contributions to employees’ pension accounts to secure their financial future. We also maintain clear policies on employee rights and responsibilities, promoting open communication to ensure a harmonious and productive workplace. Since our founding, we have upheld strong labor relations without major disputes, creating a stable and efficient work environment.

Contact

Management Dept.

Phone

(02) 2910-8118

cindy@ampower.com.tw

Customers

We are dedicated to providing reliable after-sales support, including equipment installation, operational training, and maintenance services. Our emergency response team ensures that customer needs are met promptly by supplying spare parts and troubleshooting issues to keep power systems running smoothly.

To continuously improve our service, we regularly conduct customer satisfaction surveys and use the feedback to refine our approach.

Contact

Customer Service Dept.

Phone

(02) 2910-8118

roberthuang@ampower.com.tw

Suppliers

We value strong, long-term partnerships with our suppliers, working closely with local and international companies to ensure a steady supply of high-quality materials while maintaining cost efficiency.

As part of our expansion strategy, we are strengthening our presence in the Asia-Pacific region, aligning with local energy policies to grow our market share in Taiwan, Singapore, and China while building relationships with regional suppliers and customers. At the same time, we continue expanding into European and North American markets, delivering customized, high-performance energy solutions tailored to global industry needs.

Contact

Procurement Dept.

Phone

(02) 2910-8118

procurement@ampower.com.tw

Investors

To ensure seamless communication with investors, we have partnered with a professional shareholder services agency to handle shareholder matters. Our Investor Relations section on our website provides up-to-date financial and corporate information, reinforcing our commitment to transparency.

We have also established a spokesperson system as a direct communication channel for shareholders and institutional investors. In compliance with regulations, we regularly publish financial reports, revenue updates, and key announcements to keep investors informed and engaged.

Contact

Finance Dept.

Phone

(02) 2910-8118

ir@ampower.com.tw

If the company generates a surplus in its annual financial statements, it will first allocate funds for taxes and cover any past losses. Then, 10% of the remaining earnings will be set aside as the statutory reserve unless it has already reached the total paid-in capital. Additional allocations or reversals of special reserves will be made as required by regulations. Any remaining earnings, along with undistributed profits from the previous year, will be evaluated based on the company’s future operational plans. After reserving the necessary funds, the board will propose a dividend distribution plan for shareholder approval.

Once the company is publicly listed, dividends, statutory reserves, and other distributable reserves may be issued in cash. Such distributions require approval by at least two-thirds of the attending board members, followed by a majority vote, and will be reported at the shareholders’ meeting.

Our dividend policy follows the Company Act and our Articles of Incorporation, ensuring alignment with the company’s long-term growth strategy, capital structure, and financial planning. Each year, we commit to distributing at least 20% of our available earnings as dividends to shareholders.

As a company operating in a capital- and technology-intensive industry with steady growth, we balance financial stability with shareholder returns. Dividends may be distributed as cash or stock, with at least 20% of the total annual dividend issued in cash.

Whistleblower Policy

Our company upholds the principles of fairness, integrity, trustworthiness, and transparency in all business activities, strictly prohibiting corruption and any form of fraudulent conduct. To reinforce our commitment to ethical business practices, we encourage you to report any suspected violations of our Procedures and Guidelines for Ethical Business Operations.

Whistleblower Email: whistleblower@ampower.com.tw

Information Required for Reporting:

- Whistleblower’s name, ID number, and contact details (address, phone number, and email)

- Name of the reported individual or identifiable information

- Specific evidence supporting the claim

Unless otherwise required by law, all personal information provided will be kept confidential and protected in accordance with applicable regulations.